"Hi, I am David and i wish to know how come possible provides a beneficial 5.6% to the a thirty season fixed and an excellent 7.694 Annual percentage rate with no points and only 3750 clsoing will cost you-by-the-way, lenders price prices by .125% expands, otherwise "eighths", which should say 5.625-" "That's merely a general rate, sir" "Precisely what do your mean it is simple?" "You may get that speed when you yourself have particular financial chaacteristics" "I am aware one to, but exactly how is it feasible you offer me good 5.6% rate of interest that have a great eight.964 Annual percentage rate? (Apr should be legally expose, by the way. The new Annual percentage rate is necessary for legal reasons to get revealed with one rate of interest, also it onlymakes genuine feel when you look at the 29 season and 15 year repaired, which was the situation. We cited a client a thirty seasons fixed last week on good 6.25% which have good six.54 Apr, which makes sense) "The new Apr is computed because of the addig the fresh new settlement costs, sir. Thus, could you be to buy property?" "Yes, I'm, nevertheless failed to address my question. Is it feasible that you estimate me personally a beneficial 5.6% to the a 30 12 months develop and next to they a keen AR away from seven.694 with just $3750 closing costs?" "I already replied issue, sir" "No, you don't. If i use people interent Apr estimator, I ought to keeps an apr of 5.76, into the offer your gave me" "The five.6% is actually a common rate, sir. "

Better, this is Nation Area, an element of the subsidiary out-of Financing Forest (I have been inquiring other loan providers to find out if it has worked having Financing tree, among them my team, the usa prominent financial, and you may None of them actually competes, this is sensible which they charged all of them to have phony ads "When finance companies vie, your profit".

Merely ponder so it. Would you actually pick a 300K car away from a car dealer that you don't learn, and you cannot see, instead using vehicles to be examined? Very, why would you will do it together with your home?

I hope this was useful, I'm a responsible mortgage administrator, and you can my personal experience with Financing tree made myself see why the community is amongst the the very least respected of these

There are hundreds of loan providers, brokers, etcetera, in the city your home is. In addition to their company utilizes you being pleased, therefore i do not have doubt on the looking lenders otherwise agents close by -Personally, i favor reputable lenders/bankers.

Your final magic. The entire suggestion is that brief companies perform a lot better than large ones with respect to that loan. Better, as i said, finance companies and you will mortgage organizations get their funds from an identical supply. The top men, naturally. Pick the biggest consumer of additional Grand field, and you will rating who is able to do the extremely into the a legal means.

The latest finance will be sold into secondary market, and you will assume who's a lot more stamina out of decission regarding if or not an excellent loan should be sold or perhaps not

I am refinancing our home now, and discovered one LendingTree wasn't very beneficial unless you wished to only begin getting in touch with arbitrary finance companies straight back, while the each of their letters are scripts you to state "blah-blah blah e mail us!" In my opinion, it absolutely was particularly joining a mortgage broker phone book. which is it really.

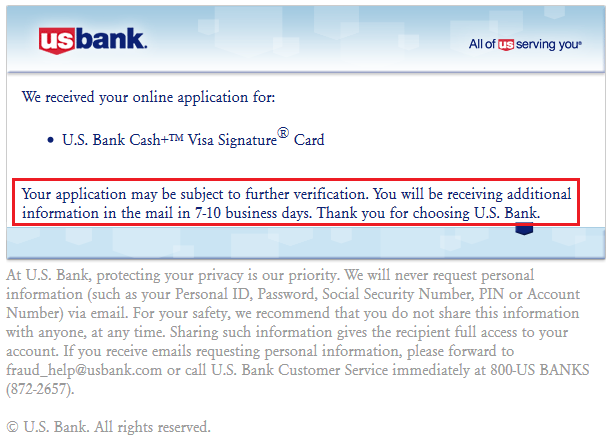

step three. Lending Forest. I understood all of them owing to Zillow. Bad options. He could be horrible, plus in Financial Oriinator News I realize they are against a nationwide Suit because of their unfair financing means (lure and button) as well as urgent link for incorrect advertising. I tried all of them myself, and i only couldn't believe it. They delivered me a quote to have a thirty seasons fixed within 5.6% interest and you may seven.694 Annual percentage rate, zero discount situations and only $3750 closing costs. That is simply Absurd. In order to have an effective 7.694 Annual percentage rate the new closing costs will have to getting $70,000. Inside the a nation in which the mediocre 30 seasons enhance now's at the 6.3% that have 1% origination fee, this business offer you a 5.6% in accordance with a good seven.694% Apr?? We entitled all of them and i encountered the following discussion: