If you're considering to buy a created family, chattel finance to own are formulated homes might be the funding provider you you need. Talking about built to funds moveable private assets, for example were created residential property. However they render unique pros and you can factors compared to conventional mortgage loans. Understanding the top features of chattel loans helps you make an informed decision towards most practical method to invest in your residence.

What's a Chattel Mortgage?

An effective chattel loan was a particular sorts of capital the spot where the financing was protected of the movable personal possessions, instance are designed belongings, auto, or equipment. So it mortgage is especially associated having are produced home located in land-book groups, where the buyer doesn't own the homes.

That have a beneficial chattel loan, buyers is also loans our home on their own of one's home. It is a great choice just in case you like the self-reliance regarding lacking to buy belongings close to their house.

Secret Options that come with Chattel Fund

- Loan Structure

Chattel finance are typically less-title loans with fees symptoms anywhere between 15 to 25 years. This can be quicker compared to the normal 29-year title out of antique mortgages, resulting in higher monthly payments. The brand new smaller term is going to be good for individuals who propose to repay the loans more quickly otherwise be prepared to move or promote in the future.

- Rates of interest

One of several services of chattel funds is that they usually have higher interest rates than just antique mortgages, sometimes 3% to help you 5% large. This type of large costs echo the increased exposure loan providers undertake because of the capital movable property.

Regardless of this, brand new entry to regarding chattel money means they are an appealing choice for many people. He's particularly welcoming to the people looking to buy a produced home instead property.

Chattel loans typically wanted reduce costs, with loan providers allowing as little as 5% off. This is going to make them available to a greater variety of buyers who might not have the latest offers to have a bigger down payment. This new function might be such as for instance good for very first-go out homebuyers or men and women trying to prevent upfront costs.

- Mortgage Wide variety

The new amounts offered as a result of chattel loans can vary extensively. As they typically include $40,000, there's will zero higher limit, according to lender as well as the home's really worth. The flexibleness allows buyers to decide belongings that suit its funds and you will tastes, whether they need anything small or higher luxurious.

Benefits associated with Chattel Fund

- Liberty

One of the primary benefits of chattel fund loan places Montezuma is the freedom. He's perfect for consumers that do perhaps not individual new home where their are created family is put. It permits to have financing solutions you to definitely conventional mortgage loans never render, making it simpler for people to get a home within the good land-lease people.

- Faster Approval Techniques

The recognition techniques to possess chattel fund is generally faster much less troublesome than just compared to traditional mortgages. New smooth techniques is beneficial of these desperate to select their domestic now and commence seeing their new living area.

- Zero Prepayment Charges

Many chattel fund already been versus prepayment charges, enabling borrowers to repay the financing very early instead of incurring most fees. This feature brings financial freedom to own homeowners which get located unforeseen windfalls or manage to make larger repayments down the range.

Considerations Prior to Securing a beneficial Chattel Financing

- Decline Threats

Are produced house is also depreciate, particularly when they are not attached so you're able to had residential property. The brand new decline can affect selling value and full investment, that is an enthusiastic imporatnt thought getting consumers looking at long-name financial effects.

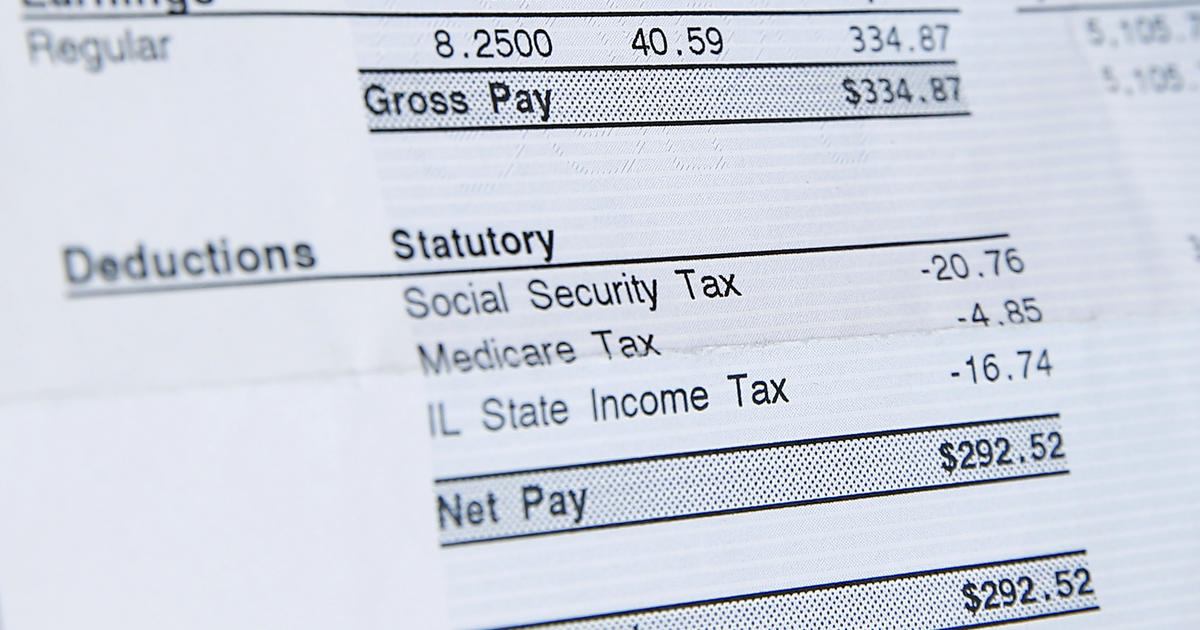

- Highest A lot of time-Term Will cost you

The combination off high rates and you can less financing conditions can end in large total money along the lifetime of the borrowed funds versus antique mortgages. Customers is always to consider this type of possible can cost you resistant to the advantages of chattel funds when making their choice.

- Possibility of Repossession

When the a borrower non-payments towards good chattel mortgage, the financial institution can repossess your house because it's noticed individual assets. Such a risk shows the significance of maintaining prompt repayments and you will that have a very good economic plan set up.

Cambio Organizations helps you find a very good financial support choices for your own manufactured household. We from professionals knows exclusive needs of homeowners and you may can be direct you through the process of protecting good chattel financing or other financing possibilities.

Discuss our organizations and contact us right now to see how i will help you in finding your ideal family. Let us help you produce your ideal off homeownership a reality.