Exactly how a broker can help

Whenever you are being unsure of how to proceed otherwise precisely what the best option is, it will always be recommended that you consult with a skilled financial agent.

An agent providing services in when you look at the no-put mortgages have a tendency to already know just and that lenders have to give selling to possess people without a hefty dollars put and will also know inside the outline different bodies techniques and other attempts particularly tailored towards the people in your situation.

Zero, which won't generally getting you can. The fresh new criteria for buy-to-assist (BTL) mortgages are stricter than it is to possess residential finance, so it will be more challenging to acquire approved for folks who don't possess in a position cash with a minimum of 20% put.

Really lenders need a twenty five% deposit to have a buy-to-let assets , and you may few wade as little as 15% however, many elite landlords release collateral off existing services to pay for which.

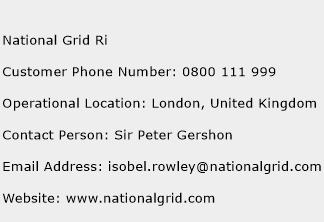

If you are looking to take out a home loan having a minimal or no deposit and wish to communicate with an expert concerning most useful options for your, can help you so by making an inquiry otherwise getting in touch with you into 0808 189 2301.

The whole-of-sector brokers we manage focus on protecting mortgage approvals for those who have no-deposit finance regarding the antique sense. We would not ask you for getting complimentary you along with your top advisor, and there's zero effect on your credit rating.

Is it possible you purchase a deposit with Cryptocurrency otherwise Bitcoin?

A number of loan providers, and additionally Barclays, Norton, and you may Age group Home, today accept cryptocurrencies, and Bitcoin, because deposit supply. See our very own publication into cryptocurrency mortgage loans.

Is it possible you get a no-deposit home loan from inside the Scotland?

If you're there are differences when considering English and Scottish assets regulations, credit strategies out-of places are a lot an identical. As well as correct elsewhere in britain, no-deposit mortgage loans on the real sense are not for sale in Scotland, you must have an equivalent reasonable-deposit options available.

Imagine if I've less https://paydayloansconnecticut.com/gaylordsville/ than perfect credit?

Really loan providers have a tendency to insist on increased deposit when you have prior less than perfect credit, but this will depend about way back the fresh new bad credit are inserted, exactly how big its as well as how well you if you don't fit the brand new conditions. A bad credit mortgage broker can help you discover the really compatible financial on your problem.

Pete, an effective CeMAP-certified financial coach and you may a professional in every some thing mortgages, clipped their teeth right in the midst of the credit crunch. With plenty of individuals needing help and you will couples financial company credit, Pete effectively ran the other kilometer to locate mortgages for all those who even more sensed missing explanations. The experience he achieved along with his passion for providing some one arrived at its goals led him to establish On line Home loan Mentor, having one to obvious eyes to simply help as many people as possible obtain the best pointers, no matter what need otherwise record.

Pete's presence in the business as go-to' having expert financing continues to grow, and then he is actually on a regular basis cited into the and you can produces both for regional and you may national push, as well as change guides, that have a regular line in Mortgage Introducer and being brand new exclusive mortgage expert to possess LOVEMoney. Pete in addition to produces to possess On the web Financial Coach naturally!

Understand that this type of mortgage loans will likely be hard for those who have no put fund. Specific lenders who can consider good guarantor is actually Generation Home, Scottish Strengthening People, Swansea and Vernon Building People.

It could including give you time to iron aside any possible borrowing conditions that you certainly will complicate taking a mortgage later. While unsure about your current credit history, you can access a totally free trial