They always goes at the worst you can easily date. You've refinanced your property, and today you are confronted with surprise expenses. It would be a medical costs, an automobile that is reached their finally days otherwise a home resolve which you cannot put-off anymore. Need extra cash, however you is almost certainly not sure in which it will come from.

Have you pondered, Must i score an effective HELOC once refinancing? New short answer is, it all depends. Never think that you could potentially otherwise cannot generate an economic move like this until you done your hunt and spoken that have lenders.

For individuals who meet with the financial official certification and now have adequate equity after their re-finance, you're able to get a great HELOC immediately following refinancing. Learn more about HELOCs, the way they works and how it relate solely to refinancing.

- What's an effective HELOC Financing and how Will it Performs?

- Sorts of Domestic Equity Money

- What's the Prepared Period Immediately after Refinancing Before Borrowers can apply to have a good HELOC?

- Select Most of the 11 Issues

What exactly is an excellent HELOC Loan and exactly how Can it Performs?

A HELOC financing are a home collateral credit line. It is technically perhaps not a loan. Alternatively, your apply for a credit line that's based on the security you possess yourself.

A line of credit really works some time eg a credit card. You make an application for an excellent HELOC, therefore the bank investigates your certificates. But not, you're not cashing out all that money at a time. Just like once you discover a credit card, you employ it necessary. Or even have to have the whole borrowing limit, it's not necessary to log in to.

Among first some thing the financial institution will look on are how much cash equity you have of your home. Your equity will be your residence's well worth less extent your debt on your own financial.

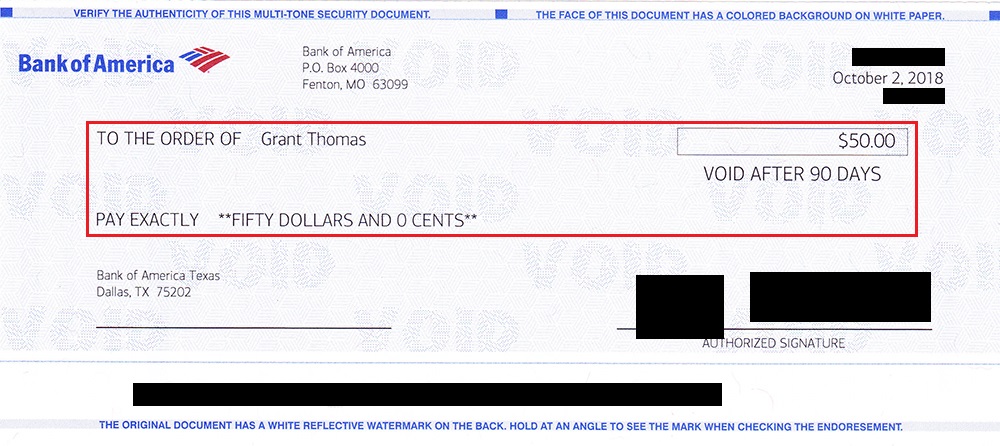

Can you imagine your home is cherished on $2 hundred,000. You owe $100,000 in your mortgage. This means you really have $100,000 in guarantee ($2 hundred,000 - $100,000 = $100,000).

Lenders commonly normally agree you for as much as 85% of your residence's well worth less the total amount you borrowed on the financial. If for example the house is cherished at $200,000, 85% per cent of these worthy of is actually $170,000. For many who nonetheless owe $100,000 on the mortgage, the quintessential you'd likely be recognized to possess is $70,000. However, the new COVID-19 pandemic has changed the way in which banking companies and you will lenders approach all of the financial device. Speak with the loan administrator on which is readily available, and you will shop around having assistance from Benzinga.

The quantity you might be accepted having is your credit line, but, as previously mentioned previously, your decide how most of one line of credit make use of.

2 Levels out of HELOCS

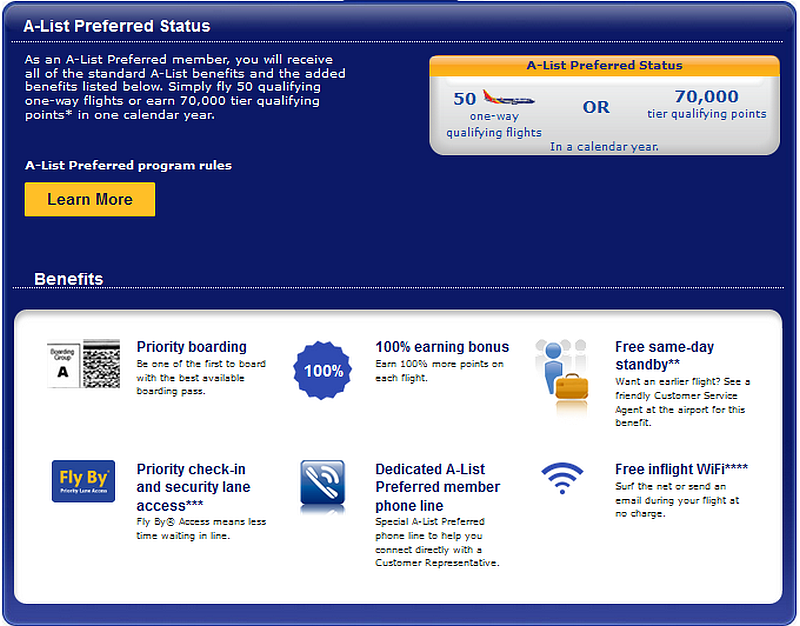

HELOCs has dos phase. The very first is actually a suck period, that is whenever you obtain (or draw) funds from your own line of credit. You typically have the very least payment via your mark several months. The size of the fresh draw months may vary from the bank but could depend on a decade.

The 2nd phase is the cost months. Due to the fact name ways, this is where you happen to be required to pay-off your own HELOC, and no further borrow cash from your own line of credit. You have higher repayments during this time period, which can continue for to twenty years. Up until now, you can even refinance again and you will roll such can cost you on the the home loan or simply find a better price.

Type of Family Equity Fund

You'll find 3 products that borrowers used to utilize their home security: HELOCs, family security financing and money-aside refinances.

House Guarantee Funds

Including a beneficial HELOC, you borrow secured on a share of your house's collateral using this types of mortgage. Unlike an effective HELOC, you can get the funds at once americash loans Deep River Center inside a lump sum payment. Your pay-off the loan more than a set title. These types of financing usually has a fixed rate of interest, meaning that they never change. You've got the exact same fee towards lifetime of the mortgage.