Dive into the world of Forex trading with this comprehensive educational guide designed to help both beginners and experienced traders enhance their skills. Understanding the intricacies of Forex can significantly improve your trading game, allowing you to navigate the currency markets with confidence and insight. For resourceful tools and strategies to aid your journey, visit forex trading education exglobal.pk to explore a range of educational materials and trading resources.

Understanding Forex Trading

Forex, or foreign exchange, involves trading currencies with the aim of making a profit. The Forex market is one of the largest financial markets in the world, with daily transactions exceeding $6 trillion. Traders speculate on the price movements of currency pairs, such as EUR/USD or USD/JPY, by buying one currency while selling another.

Key Concepts in Forex Trading

Currency Pairs

In Forex trading, currencies are traded in pairs. This means that when you place a trade, you're always buying one currency while selling another. The first currency in the pair is known as the base currency, and the second is the counter currency. The exchange rate indicates how much of the counter currency you need to buy one unit of the base currency.

Pips and Lots

A "pip" is a unit of measurement that represents the smallest price movement in the Forex market. Typically, it refers to a change in the fourth decimal place in a currency pair (e.g., a movement from 1.3450 to 1.3451 is one pip). Traders buy and sell in varying quantities known as "lots." A standard lot is 100,000 units of the base currency, while mini and micro lots represent 10,000 and 1,000 units, respectively.

Leverage and Margin

Creating a Trading Plan

A well-thought-out trading plan is essential for success in Forex trading. It should encompass your trading goals, risk tolerance, analytical methods, and strategies. Establishing clear entry and exit points, along with stop-loss orders, can protect your account from significant losses. Here are the key components to include in your trading plan:

- Goals: Define your financial objectives and the time frame in which you want to achieve them.

- Risk Management: Determine the amount of capital you are willing to risk per trade.

- Market Analysis: Choose your preferred method of analysis, whether technical, fundamental, or a combination of both.

- Strategy: Develop specific strategies based on your market analysis that you will follow in your trades.

Technical Analysis vs. Fundamental Analysis

Two primary methods of analysis are commonly used in Forex trading: technical and fundamental analysis. Both approaches can provide valuable insights into market trends and price movements, and many traders choose to combine both strategies.

Technical Analysis

Technical analysis involves studying historical price data, chart patterns, and various indicators to predict future price movements. Traders often use tools like moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels to identify entry and exit points. The underlying tenet of technical analysis is that price movements reflect all relevant information, which is encapsulated in the market price.

Fundamental Analysis

Fundamental analysis focuses on economic indicators, interest rates, geopolitical events, and financial news that may impact currency values. Traders who use this approach analyze factors such as GDP growth, unemployment rates, and inflation to understand the overall health of an economy and make informed trading decisions. By staying updated on global events and economic releases, traders can anticipate how these factors will affect currency pairs.

Psychology of Trading

The psychology of trading plays a significant role in a trader's success. Emotional decisions can lead to impulsive trades, causing unnecessary losses. Key psychological factors include:

- Fear and Greed: These two emotions often lead to poor decision-making; fear may prevent a trader from entering trades, while greed might push them to take excessive risks.

- Discipline: Sticking to your trading plan and not deviating under emotional pressure is crucial for long-term success.

- Patience: Waiting for the right setup and not forcing trades can vastly improve your trading performance.

Choosing a Forex Broker

Selecting the right Forex broker is essential for a successful trading experience. Here are some key factors to consider when choosing a broker:

- Regulation: Ensure that the broker is regulated by a reputable financial authority to protect your funds.

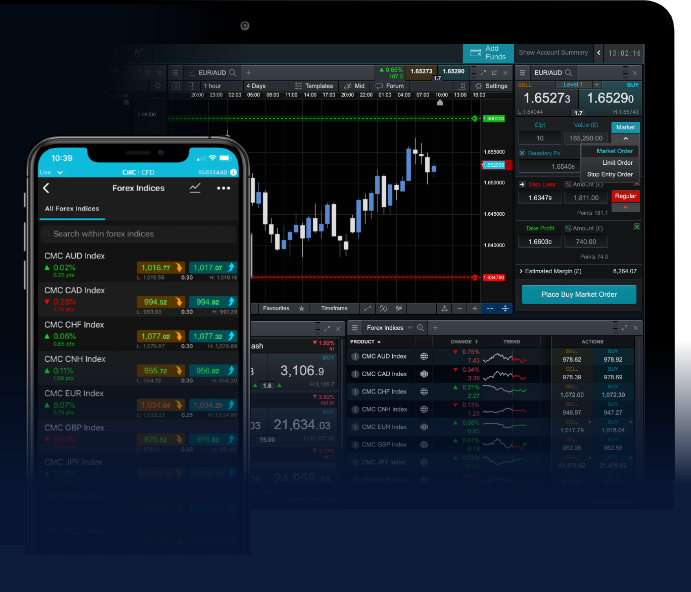

- Trading Platform: Check the broker's trading platform for ease of use, available tools, and stability.

- Spreads and Commissions: Compare spreads and commissions offered by different brokers, as these can affect your overall profitability.

- Customer Support: Good customer support can be crucial when you encounter issues or have questions about your account.

Continuing Education in Forex Trading

The Forex market is dynamic and constantly changing, making continuous education vital. Traders should stay up-to-date with market news, economic data releases, and emerging trends. Consider leveraging the following resources to enhance your trading education:

- Online Courses: There are many online platforms offering Forex trading courses tailored for all skill levels.

- Webinars and Workshops: Participate in webinars hosted by industry experts to gain insights and skills.

- Trading Simulators: Utilize demo accounts or trading simulators to practice without financial risk.

- Books and Articles: Read books and articles from experienced traders and educators to expand your knowledge base.

Conclusion

Forex trading can be a rewarding venture for those who take the time to educate themselves and develop a solid understanding of the market. By mastering the key concepts, creating a comprehensive trading plan, managing risk, and continuously striving for improvement, you can enhance your chances of success in the dynamic world of Forex trading. Remember that education and practice are ongoing, and the more you learn, the more effective you will become as a trader.