It could be difficult to residential property a mortgage, however for particular consumers that have the fresh bucks companies unofficially, bank comments or site emails will be all documents necessary. Pictures because of the ASHLEY FRASER/Postmedia

Simple tips to be eligible for home financing in case your newest earnings does not work Back once again to video clips

People look for cost coming down; they want to buy a property - maybe because they do not envision cost will stay off for very long - nevertheless they cannot confirm sufficient income to obtain a home loan.

What direction to go? Better, unless you are a separate elite group such as for instance a doctor otherwise dental expert, or if you be eligible for rigid specific niche credit software, you can also get approved centered on a serious online worthy of, biggest banking companies will most likely make suggestions the doorway.

- Exclusive stuff from Barbara Shecter, Joe O'Connor, Gabriel Friedman, although some.

- Daily posts away from Monetary Moments, the newest planet's best around the globe business guide.

- Limitless online entry to see posts of Financial Article, National Article and you can fifteen development internet sites across Canada having you to membership.

- National Blog post ePaper, a digital replica of your printing release to access on the people unit, show and touch upon.

- Exclusive posts of Barbara Shecter, Joe O'Connor, Gabriel Friedman although some.

- Each and every day posts of Financial Times, the fresh earth's top worldwide company publication.

- Endless on the web use of realize articles from Financial Article, National Post and you may 15 development websites round the Canada having you to account.

- National Post ePaper, an electronic digital imitation of your printing edition to get into toward any product, express and you can touch upon.

Check in otherwise Perform an account

Thankfully, big banking companies never totally monopolize Canada's home loan field. Choice lenders can sometimes provide your much more centered on your general ability to spend. Hence ability cannot merely other people in your money now.

1. Contributory money

Family members will processor during the to the bills - consider grandmother living in the fresh guest space or your friends inside a call at-laws room. Such loved ones may not be to your title to your property, but alternative loan providers tend to envision the payments whenever working out for you meet the requirements having home financing.

Specific loan providers might become well-reported area-go out or concert income (handyman, Uber rider, an such like.) instead requiring common a couple of-season money history.

Canadians are great on looking innovative ways to earn more money because of their family unit members, claims Offer Armstrong, head out-of financial originations at Questrade Financial Group's Community Faith Organization. Once the a loan provider in these cases, our company is looking practical income that shows a normal pattern and can be noted going back three, six, nine otherwise 12 months.

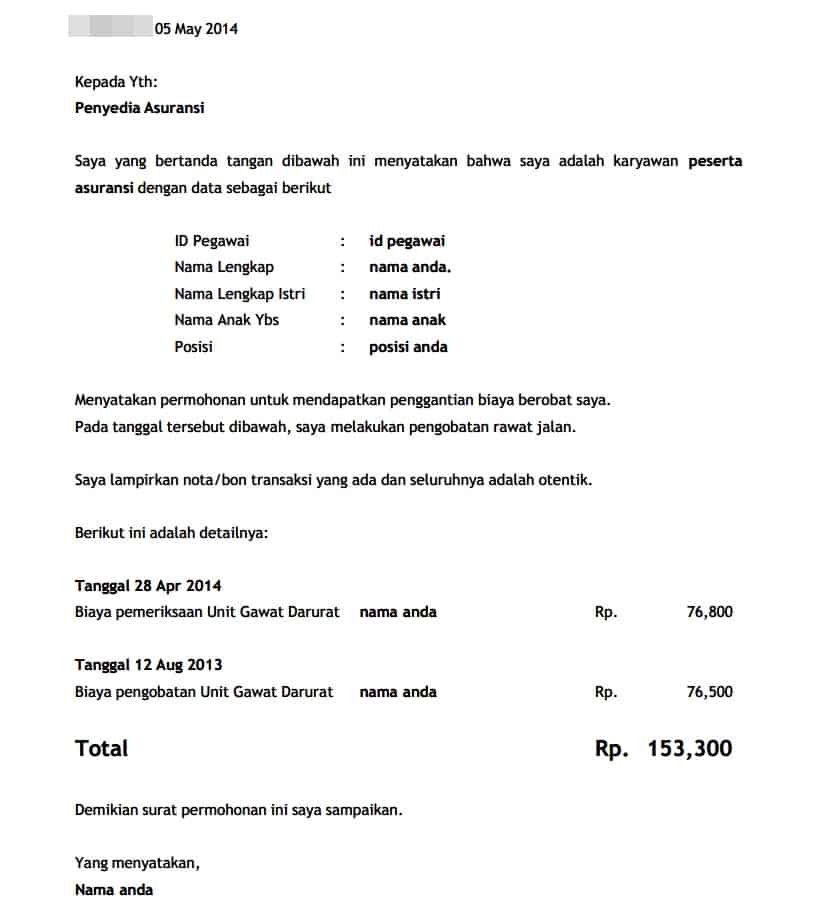

For the majority consumers having the newest bucks enterprises unofficially, bank statements or resource letters could well be all the documents necessary. Was providing one to acknowledged on an enormous lender, especially if you keeps a lowered credit history.

dos. Upcoming income

To have benefits particularly medical professionals, dental practitioners or lawyers, a full time income surge later on is virtually a given, and lots of loan providers are willing to bet on you to.

Non-top-notch individuals may also have being qualified future money, and additionally the individuals pregnant child assistance, alimony, leasing or retirement earnings in the close-term.

Also newcomers who possess merely released an excellent Canadian organization or those individuals transitioning from a constant paycheque so you're able to worry about-a job are able to find loan providers prepared to provide the green white. They just need to reveal its income load is done.

step 3. Quick assets

installment loans online KansasSome lenders assess simply how much you can afford for the expectation you could turn the property into the dollars. When you have tall possessions, i've software that will power one for the next couple age, says Armstrong.

Cash, otherwise whatever would be readily changed into cash, will help a lender validate exclusions so you can their loans proportion constraints (i.elizabeth., the utmost percentage of revenues a loan provider enables property and you will loans money). Certain lenders will additionally think RRSPs as a way to validate a more impressive loan amount.

cuatro. Upcoming assets

Individuals who possess indexed another assets obtainable, possess a rely on finance upcoming offered or anticipate a heredity while in the the loan name all the has future dollars accessibility . Choice loan providers can sometimes matter a portion of those assets once the a means of financial obligation upkeep or repaying the borrowed funds.

Certain might envision retained dollars which is resting in the a business membership, so long as its unencumbered and you've got unfettered accessibility the cash any time.

The fresh new tradeoff

In daily life plus in mortgage fund, independence tend to has a selling price. Solution loan providers fees highest prices with regards to increased expense away from protecting loans and higher risk inside it.

Generally speaking, individuals that happen to be otherwise certified pays low-perfect lenders a rate which is at least one to just one and you can a half fee points high, plus a one % payment - given he's got a powerful credit character, no less than 20 per cent guarantee and a marketable domestic. Smaller guarantee you'll push the interest up by at least a different sort of 30 to help you 50 foundation items, if for example the financial also believes on bargain.

If you have missed several payments in the last few years, or your home isn't really in the city or burbs, or perhaps the home loan amount are well over $one million, otherwise its an investment property, expect to pay materially more.

And you can about this collateral - it's critical for non-best loan providers. They demand a substantial equity boundary while the insurance coverage up against the higher default prices regular of non-best individuals. That's the only way they could be certain that they will certainly get well their money if some thing lose their freshness additionally the debtor will not pay.

Generally speaking, the latest sketchier your credit otherwise wonkier your income situation, the more equity you may need, possibly around 35 % or more. Some loan providers succeed 2nd mortgages at the rear of their basic in order to obtain alot more, nevertheless wouldn't including the interest on that 2nd.

The new takeaway is the fact there are lots of equipment for the a good home loan broker's toolbox to locate a borrower recognized. If you're unable to take action in the a lender yet still want a mortgage, they generally boils down to one to concern, How are you currently thinking about and then make your mortgage payments now, tomorrow and you can a year regarding now?

But, simply because individuals could possibly get acknowledged for home financing does not always mean they must. Many of these workarounds is meant for people that will pay the financial without a doubt. When you have actually a hint off value one, continue on renting.