A house guarantee line of credit, otherwise HELOC for short, is that loan that utilizes the fresh equity you have achieved on your own home given that guarantee. Normally, good HELOC are calculated of the deducting the total amount your debt with the their financial regarding up to 85% of your appraised value of your residence.

Because acknowledged amount borrowed may still count on the debt-to-income (DTI) ratio along with your credit history, your debts can be obtained whenever you want it, and also you pay just attention towards the amount you obtain.

But not, good HELOC is almost certainly not the best selection for everybody, as it can place you susceptible to shedding your home should you not have the ability to generate repayments. Prior to taking one to aside, observe an excellent HELOC work and you may whether or not the https://elitecashadvance.com/payday-loans-wv/ fees framework is appropriate to suit your state.

What is property Security Credit line (HELOC)?

An excellent HELOC is a good revolving credit line secure by your house's guarantee. Loan providers look at the credit history and you can obligations-to-money (DTI) proportion and make certain you've got no less than 15% security of your property to meet the requirements. From that point, it ount you could potentially acquire, and you will withdraw people number below otherwise doing your own approved limitation having fun with a great checkbook otherwise a credit card connected to the fresh new account.

HELOCs typically have a draw several months, a period of time during which you could potentially obtain on membership. Once this period try right up, you are going to need to renew your line of credit otherwise initiate paying the quantity you owe.

HELOCs fundamentally include a varying rate of interest, which means that your money changes throughout the years. A variable price can work to your benefit when it happens down, in case it goes right up or you can not any longer pay for to repay, you deal with the possibility of dropping your residence.

You reside equity towards HELOC, when you standard into the costs, the financial institution takes your property and make up for this. If you decide to sell your residence, try to pay your own HELOC included in the method.

Just how do HELOCs Work?

When you're recognized getting a beneficial HELOC, loan providers often agree your for a maximum number which is predicated on several activities, including how much cash guarantee you've got of your property along with your credit rating. This new guarantee in your home refers to the property's total worthy of, minus all you already owe towards mortgage loans and you will family guarantee financing. HELOCs has a loan application techniques like a normal mortgage, that involves deciding on your overall financial visualize.

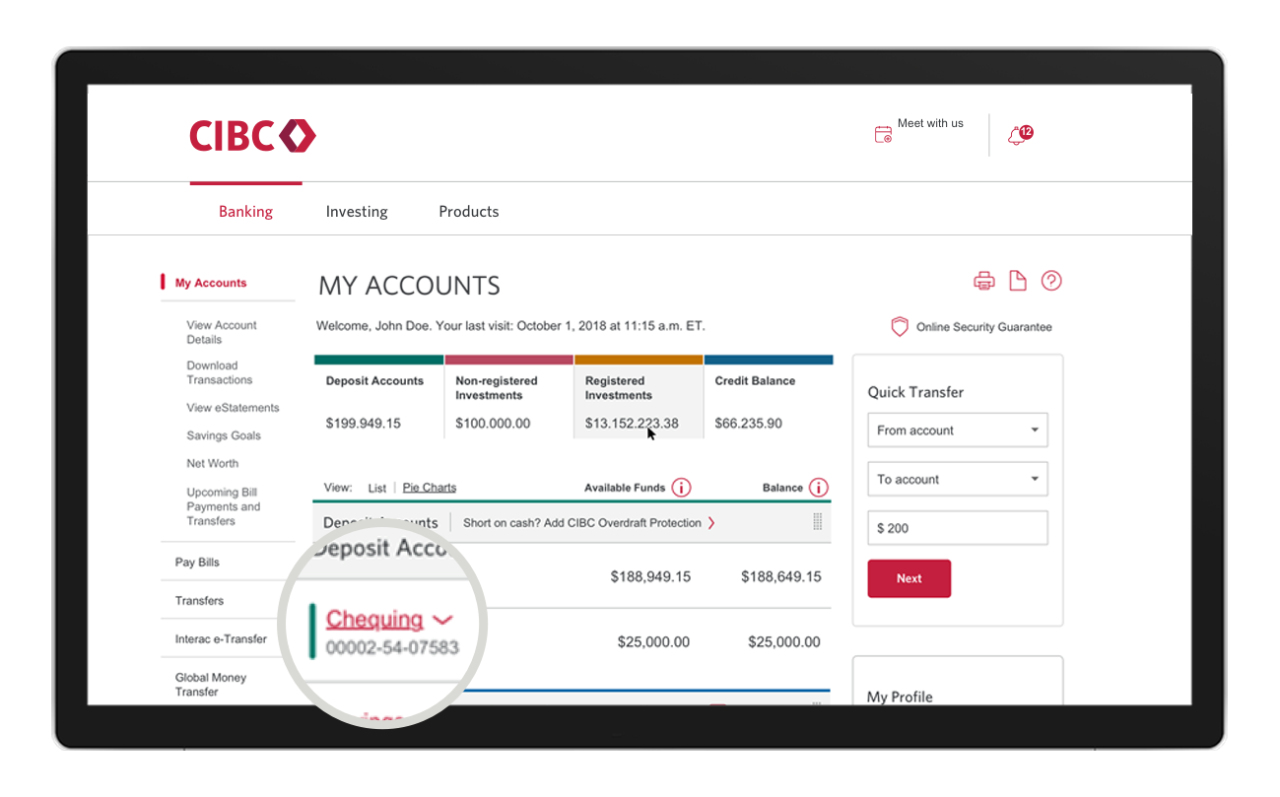

The credit into a HELOC revolves. Just like a charge card, as you pay the primary, your debts is reduced and you can readily available borrowing from the bank replenished. Particular plans features constraints about how you can utilize these types of financing, that have lowest detachment numbers and you will a great harmony limits. Certain loan providers need an initial progress if line is done. According to the bank, you may use the HELOC of the writing a, playing with a great debit card that is linked with brand new account or simply just going finance into your checking account.

HELOCs generally cover a variable, as opposed to repaired, rate of interest. The brand new rates must be penned with the a community list (for example an everyday papers) and additionally be subject to constant alter. Loan providers basically offer an excellent margin for the directory, by laws, variable-rate plans always have a cap towards interest rates. Although not, if you have burned up your credit line and are generally having difficulties paying it down, you will probably find the pace hiking so you can an irrepressible top - whether it is capped or not.