Earnings Needed for good 400k Home loan

Of numerous homebuyers are shopping on $400k assortment and so are curious if their money was sufficient so you're able to be eligible for the mortgage. This seems to be a familiar finances and you can fits in this new FHA loan limits for each and every condition in america.

On this page, we're going to determine what your income must be to help you pay for an effective $400k mortgage and you may just what details commonly effect what you can do so you can be considered.

The funds necessary for a great $400k financial try regarding $67k in order to $78k annually depending on and therefore financial program you decide on, other loans, taxation and you can HOA charge.

For every single financial program has actually an alternative deposit requirement and several possess a good PMI needs although some do not. If you have PMI, it means your income may prefer to feel highest to cover the an excellent 400k home loan as you need overcome one month-to-month PMI commission.

You will find multiple applications you could submit an application for in order to be eligible for an excellent $400k mortgage. FHA, Traditional, Virtual assistant and USDA wanted full income files. There are more choices that have larger advance payment requirements but versus money confirmation to help https://paydayloansconnecticut.com/botsford/ you will get qualifying convenient.

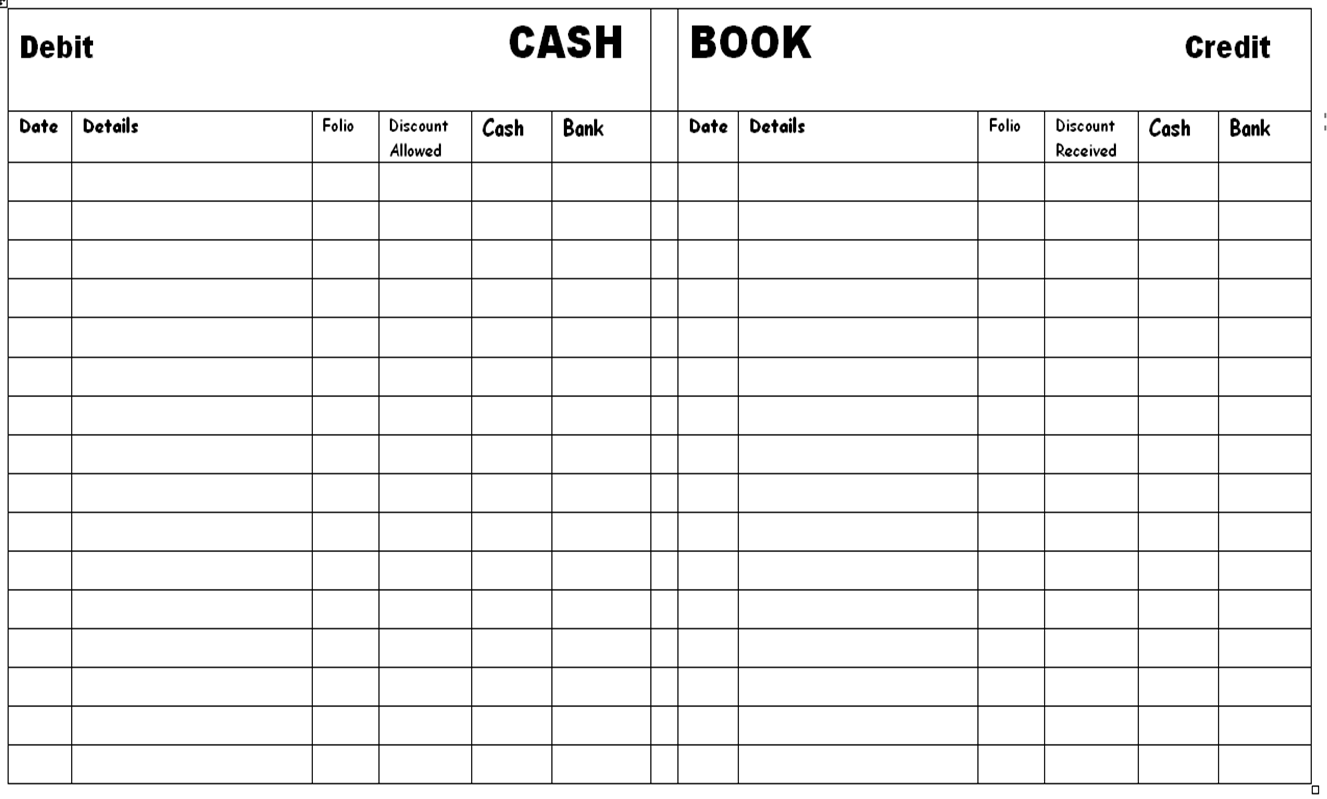

That it earnings necessary for an effective $400k financial chart below suggests the differences anywhere between mortgage software, down payment, DTI requirements , as well as how much money is needed for each and every without other loans.

- Income tax speed of just one.5%

- Homeowner's cost from $1000 per year

- Rate of interest of 5.5%

- No other the obligations or monthly premiums on the credit history

Please note one to a 20% down-payment to have a normal loan is not needed, but eliminating new PMI by the getting down 20% causes a lowered yearly income wanted to be eligible for good $400k mortgage.

You will find some considerations to adopt when trying to be considered to own a beneficial 400k financial regardless of the your revenue try.

Earliest, the fresh new yearly taxation into the domestic you are in search of tend to gamble a primary character in the manner far money needs for a good $400k mortgage. The higher the taxes, more just be sure to secure so you can meet the requirements. That is something you need to pay attention to when considering your commission budget.

For this reason, whenever you are in a position to shop for belongings where in fact the taxes is straight down, then you definitely do not need as often money in order to be eligible for a great $400k house.

Next, if you find yourself to invest in property or a condo that has an enthusiastic HOA (homeowner's organization) fee, which also mode try to earn significantly more so you can be considered. Homeowner's relationship costs really do consume on simply how much you could qualify for.

Often times, you may have to generate 29% much more simply to manage property or an apartment having an association fee.

Ultimately, the borrowed funds program of your choosing extremely commonly matter. You will see throughout the graph you never you would like because most of a full time income while trying to get a beneficial $400k FHA loan. Even in the event all of the FHA loans has a month-to-month financial insurance coverage commission, the fresh new deductible DTI is much large you are able even more.

Just how to Be eligible for good $400k Home loan

Before doing a software, consider what finances otherwise commission youre at ease with. 2nd, see just what you savings you may have to possess a downpayment and you can closing costs.

The borrowed funds officer goes due to certain qualification criteria including a career, work stability, your coupons, and you may credit file. Just be sure to have thirty days out of view stubs, two months lender comments, couple of years out-of W2's and you may 2 years out-of taxation statements.

If you want observe how much cash you can be considered to possess, explore the house Affordability Calculator to help determine that for you. The calculator usually takes your current earnings, financial obligation, upcoming family taxation and insurance to incorporate a straightforward guess to have you.

First-time home buyers will you want anyone to help guide them through the means of to shop for a home or even bringing pre-licensed. You need to consult with financing manager well before your see which have an agent so you're able to journey land.

One of our mate bank may have initial discussions with you select where you're within the qualifying to own a mortgage and also to determine if some thing such as for example credit scores otherwise down payment means becoming worked tirelessly on.

Frequently asked questions

Exactly what affairs create loan providers think whenever examining income having a $eight hundred,000 home loan? Lenders will look at the money, debt, suggested taxation and you can insurance on property, and you will current interest levels whenever deciding whether or not you could potentially qualify for a beneficial $400k financial.

Were there specific loans-to-money ratios that have to be met? The debt to money percentages vary dependent the mortgage program and financial. FHA loans particularly enables doing an effective 56.9% DTI which have good credit.

Should i include my spouse's money when figuring the cash necessary having a good $400,000 mortgage? You can include the spouses earnings nonetheless it need to be fully noted.

Manage loan providers possess different standards for various style of mortgage loans? Lenders possess some other conditions with other mortgage loans that may perhaps not require money paperwork.

How come credit history affect the income conditions getting an excellent $400,000 mortgage? Credit ratings change the earnings requisite because your ratings determine the new interest offered. The lower the pace, new faster income you would need to be considered.

Ought i use leasing earnings within my personal being qualified money? You are able to leasing earnings within your being qualified money if that leasing income is reflected on your own taxation statements. You'll should also is one home loan, income tax and you can insurance policies money into leasing assets to your personal debt side of the application.

What are the specialized financing software with other earnings criteria? There are stated money funds that do not require you to establish your earnings.