The definition of domestic mortgage covers various kinds of funds eg house renovation fund, link fund, plot fund, house framework funds, an such like.

There's a myth one of people that lenders and area finance are identical. Even though there are a handful of resemblances between the two, both of them provides several variations.

Immediately, for having a home loan, you may have to shell out nearly seven

- The purpose and location of your home

You can get home financing for buying one in a position assets, a property less than design otherwise a great resold home. On the contrary, spot finance might be availed for buying residential property, providing you make use of the homes to have home-based motives. Thus, truthfully, you cannot use home financing to own obtaining a story out-of home or cannot sign up for an area loan to buy a accomplished or lower loans in Salmon Brook than-build assets.

Nowadays, in order to have a mortgage, you might have to pay nearly 7

- Mortgage in order to Worthy of (LTV) and you will Mortgage to Rates (LCR) ratio

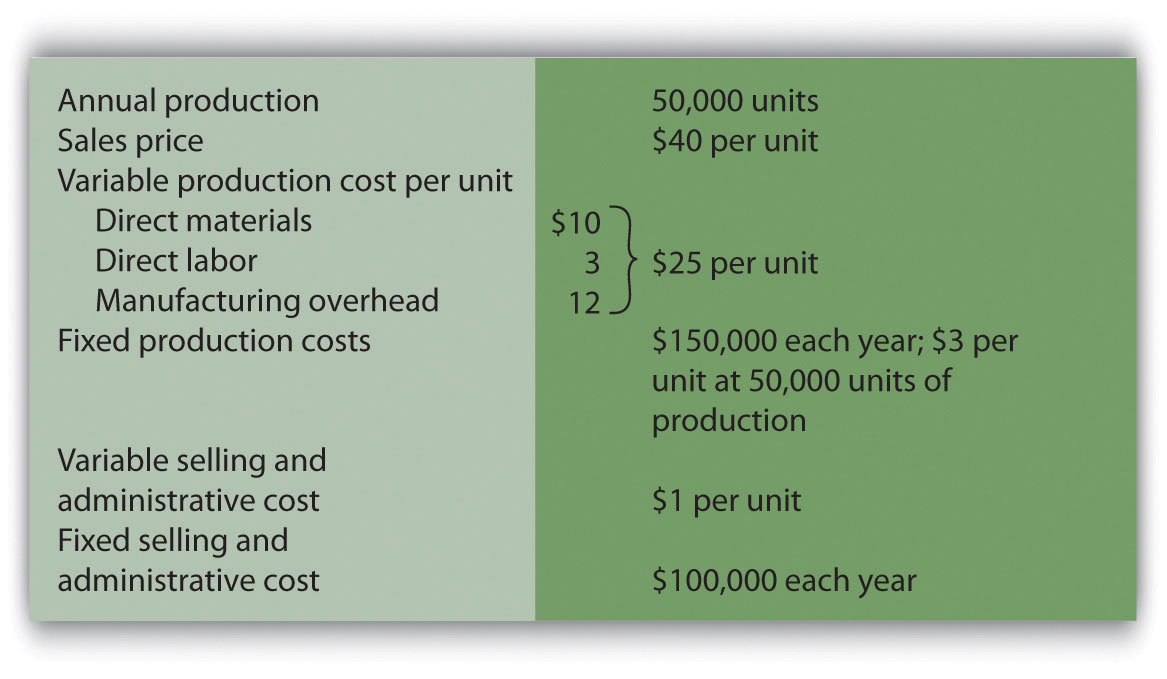

The mortgage to Worthy of (LTV) otherwise financing to help you rates (LCR) ratio stands for the utmost amount borrowed you can aquire contrary to the liquidation value of the house or belongings you wish to get. Since you make use of the possessions just like the security, brand new LTV/LCR gets large into a mortgage than a story loan.

Generally, if you're obtaining a home loan, a debtor can get financing out of nearly 75% so you can 90% some bucks of the home. not, to possess a block of land financing, you might constantly rating an optimum financing (LTV) out of 75% to 80% of the land-value.

Immediately, for having a mortgage, you might have to spend nearly eight

- Tenure of the mortgage

Our home financing period was quite a lot of time when compared with the mortgage pulled having belongings. You could avail of a home loan having an extended tenure off 30 years. Yet not, with respect to installment out-of a story mortgage, you could usually rating an optimum period of fifteen years.

Today, in order to have a home loan, you might have to pay nearly 7

- Income tax gurus

On the other hand, zero taxation benefit comes in a land loan if you do not build property inside. For folks who make property to the house, you will be eligible for taxation write-offs, but you'll get it simply into part of the amount borrowed you have taken to possess developing the structure.

Now, in order to have a home loan, you may need to pay nearly seven

- Rate of interest

Once you pick a mortgage, you can enjoy an income tax deduction for the principal amount when you look at the inclusion with the number you have to pay to the attention

When compared with family mortgage, loan into plots appeal highest interest levels. 50% due to the fact desire annually, while you could generally get area fund if you are paying 8-10% desire a-year.

Immediately, for having a mortgage, you may need to shell out almost seven

- The new candidate must be an Indian citizen

- Age limitation from salaried people and thinking-working persons are between 23 to help you 62 decades and you may twenty five in order to 70 years, respectively.

- Minimal works exposure to this new applicant can be at least step 3 ages

- The experience getting self-functioning people might be no less than five years

The newest measures to try to get a story financing and homes loan are almost comparable with each other. He or she is below:

Today, that you experienced the distinctions ranging from a home loan and good patch financing, you could responsibly find the one to based on your needs. Keep the essential data useful before you apply so you can speed up the applying processes and reduce probability of rejection.