All about cryptocurrency

While there are some places where you can spend bitcoin, many people just hang on to them, like you would with other long-term investments. The price volatility of bitcoin makes it difficult to transact day-to-day purchases -- though a handful of crypto-powered debit and credit cards are beginning to change that rocketplay casino reviews.

Each transaction is verified by network participants through a consensus mechanism known as Proof of Work (PoW), where miners compete to solve complex mathematical problems. The first miner to solve the problem adds a new block of transactions to the blockchain and is rewarded with newly created bitcoins and transaction fees.

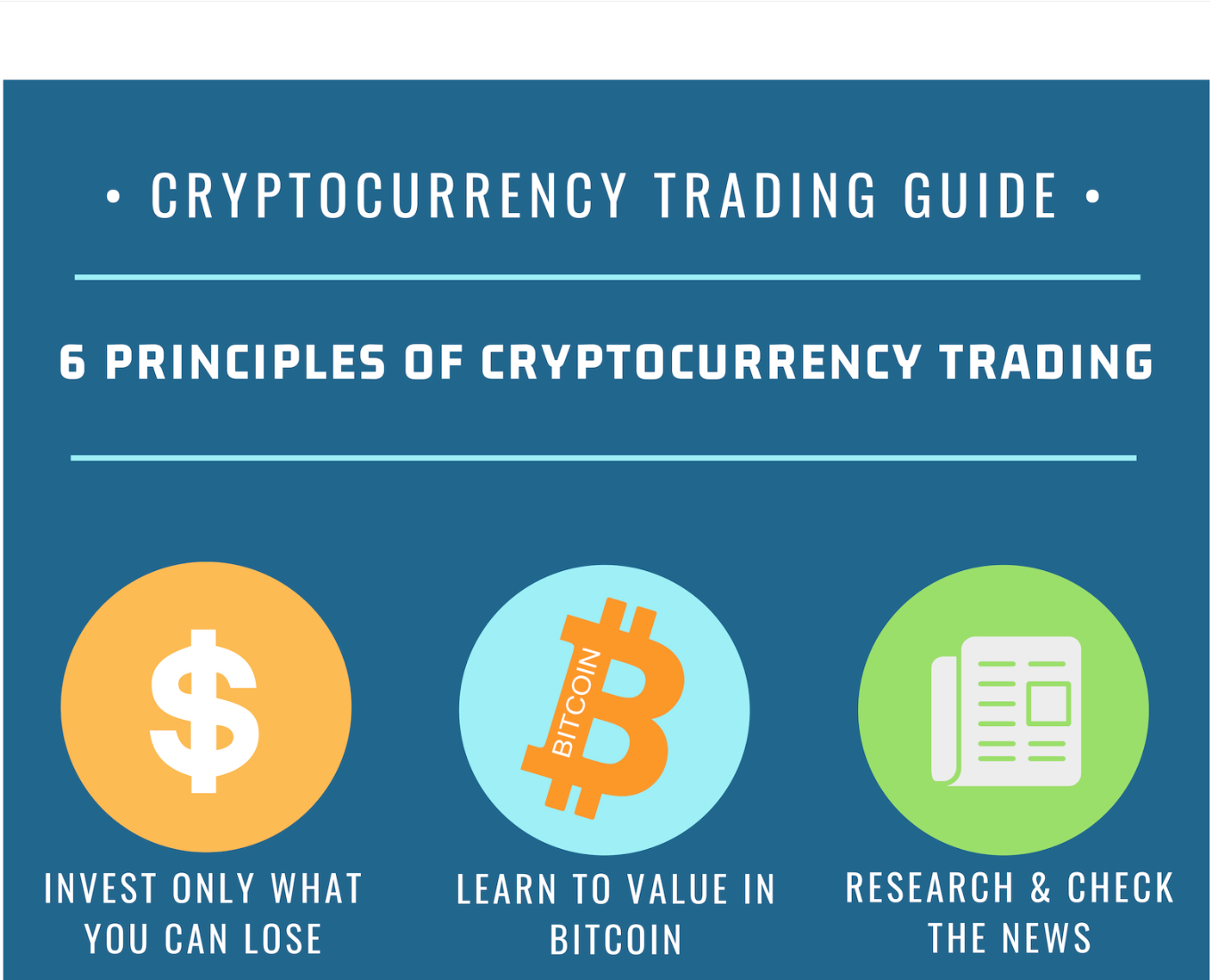

All about cryptocurrency trading

Another good advantage of long-term cryptocurrency trading is that you don’t need lots of money to get started. You can buy small amounts whenever you have some spare money, and let it grow over a long period of time.

Automated crypto trading tools and crypto trading bots that use artificial intelligence are emerging technologies that can help crypto trading strategies. But like all trading tools and indicators, they are best used with other tools, methods and deep knowledge of how to trade cryptocurrencies to confirm trends and support trading decisions.

If the closing price is higher than the opening price, the body is typically filled or colored in, often with green or white, to indicate a bullish session. Conversely, if the opening price is higher than the closing price, the body is empty or colored in red or black, signaling a bearish session.

It’s hard to talk about crypto trading without talking about risk management in cryptocurrency trading. It is another essential part of your success journey. Risk in crypto trading refers to the chance of an undesirable outcome happening.

What is cryptocurrency

Mining for proof-of-work cryptocurrencies requires enormous amounts of electricity and consequently comes with a large carbon footprint due to causing greenhouse gas emissions. Proof-of-work blockchains such as bitcoin, Ethereum, Litecoin, and Monero were estimated to have added between 3 million and 15 million tons of carbon dioxide (CO2) to the atmosphere in the period from 1 January 2016 to 30 June 2017. By November 2018, bitcoin was estimated to have an annual energy consumption of 45.8TWh, generating 22.0 to 22.9 million tons of CO2, rivalling nations like Jordan and Sri Lanka. By the end of 2021, bitcoin was estimated to produce 65.4 million tons of CO2, as much as Greece, and consume between 91 and 177 terawatt-hours annually.

Instead, the computers participating in the network are tasked with verifying and facilitating each “block” (i.e., entry or transaction) within the chain. In some cases, all the computers work together to verify and facilitate each block action. In other cases, a group of computers is selected at random.

Hobby investing isn’t the only way to work with cryptocurrency. You’ll also find various cryptocurrency-related jobs, including some careers that don't work directly with the investment side but with clients who do. Examples include business development representatives and marketing managers.

That said, for clients who are specifically interested in cryptocurrency, Ian Harvey, a New York-based wealth advisor, helps them put some money into it. “The weight in a client’s portfolio should be large enough to feel meaningful while not derailing their long-term plan should the investment go to zero,” says Harvey.

Some miners pool resources, sharing their processing power over a network to split the reward equally, according to the amount of work they contributed to the probability of finding a block. A "share" is awarded to members of the mining pool who present a valid partial proof-of-work.

In 1996, the National Security Agency published a paper entitled How to Make a Mint: The Cryptography of Anonymous Electronic Cash, describing a cryptocurrency system. The paper was first published in an MIT mailing list (October 1996) and later (April 1997) in The American Law Review.